The 5-Minute Rule for Paul B Insurance Medicare Supplement Agent Huntington

Learn a lot more concerning Medicare.

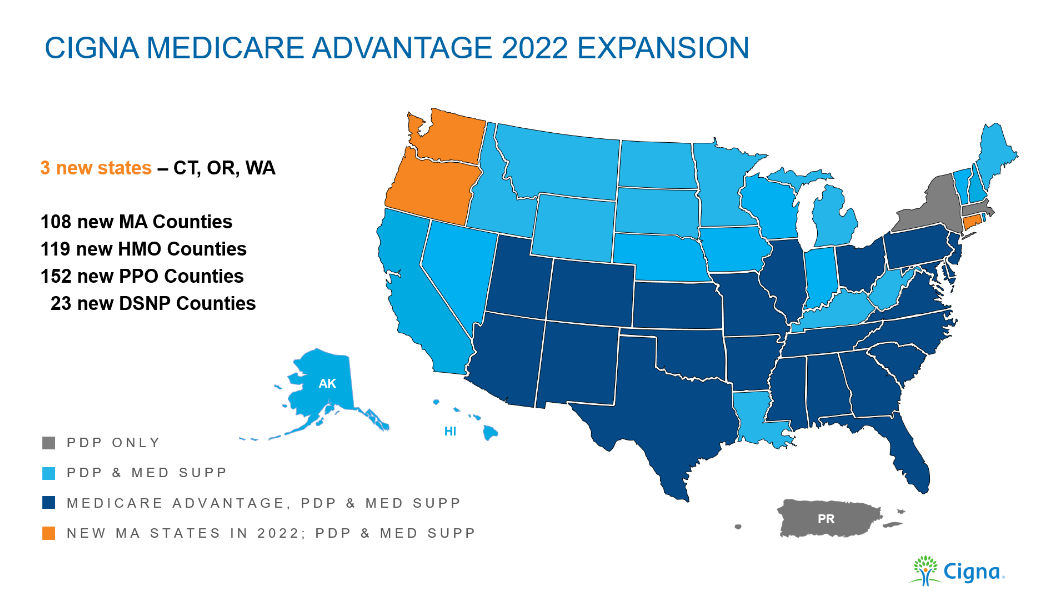

Premiums as well as copayments use, however they're generally income-based and might be subsidized. Medicare Advantage (Component C) strategies are private insurance plans. These strategies combine several components of Medicare, like parts An as well as B, with various other services, such as prescription, oral, and vision insurance coverage. They use much more solutions, but they could cost more and also come with network constraints.

However different strategies can pick which medicines they list in their medication listings or formularies. Many prescription drug strategies group covered medications by: formulary, which is a checklist of prescription medicines covered in the plan normally with at the very least two selections for every drug course or categorygeneric medicines that may be replaced for brand-name medicines with the exact same effecttiered programs that offer various degrees of drugs (common only, generic plus name brand name, and more) for a variety of copayments that boost with your medicine rates, The expense of Medicare Part D plans relies on which prepare you choose and what medicines you need.

Little Known Facts About Paul B Insurance Medicare Insurance Program Huntington.

Medigap plans may not might all out-of-pocket costs, expenses you yet find the one that best suits finest financial and monetary and alsoHealth and wellness Below's an introduction of what each of the 10 Medigap strategies cover: * After January 1, 2020, individuals who are brand-new to Medicare can not use Medigap plans to pay the Medicare Component B deductible.

It can take some time and also effort to look through the lots of sorts of Medicare plans. However these alternatives give you much more selections when it concerns protection and also the price of your healthcare. When you're very first qualified for Medicare, make certain to assess all its parts to find the very best suitable for you and also stay clear of penalties later.

What Does Paul B Insurance Insurance Agent For Medicare Huntington Mean?

The info on this site might help you in making personal choices regarding insurance policy, however it is not meant to provide advice regarding the acquisition or usage of any insurance or insurance policy products. Healthline Media does not transact the organization of insurance coverage in any type of manner as well as is not certified as an insurance firm or producer in browse around here any kind of united state

Healthline Media does not recommend or recommend any type of 3rd celebrations that may negotiate the business of insurance policy.

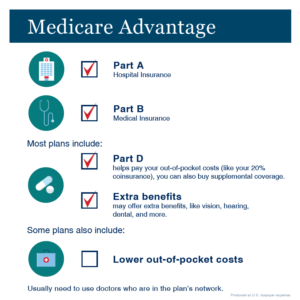

Many Medicare Benefit plans additionally use prescription drug protection as well. In contrast to Original Medicare, there are numerous benefits and benefits when picking a Medicare Advantage strategy. When picking your Medicare protection, you might select Original Medicare or Medicare Benefit, additionally referred to as Medicare Component C. Medicare Benefit prepares cover all the solutions that Original Medicare covers besides hospice treatment.

Consider your long-lasting healthcare requirements and consider which plan will fit your choice. Determine exactly how much you are eager to spend on your healthcare on a month-to-month and also yearly basis. Regular monthly costs, annual deductibles, and also copays may be included in your Medicare Advantage strategy prices. Some strategies might charge a couple hundred dollars for premium as well as deductibles and also various other strategies might not charge you anything.

7 Simple Techniques For Paul B Insurance Medicare Part D Huntington

There are many aspects to think about when picking a Medicare Advantage plan or Original Medicare. Prior to making a decision on which strategy to select, it is vital to look at all your choices and also weigh in prices and advantages to decide on the protection that functions best for you.

Prior to you enlist in a Medicare Advantage intend it's essential to recognize the following: Do all of your service providers (medical professionals, healthcare facilities, and so on) accept the strategy? You should have both Medicare Components An and B as well as live in the solution location for the plan. You need to stay in the plan till the end of the calendar year (there are a couple of exceptions to this).

, you might have the option to register in a Medicare Benefit strategy. (Medicare Component C) is an alternate method to get your Medicare Component An and Part B insurance coverage. It does not replace your Medicare Component An and Part B protection.

These strategies are readily available from exclusive, Medicare-approved insurance companies, and they're enabled to provide additional advantages past Part An as well as Part B. Some plans include prescription medication protection. Plans might include routine for dental and also vision treatment and also various other health-related solutions not covered by Initial Medicare (Component An as well as Part B).

Getting My Paul B Insurance Insurance Agent For Medicare Huntington To Work

Medical Cost Savings Accounts (MSA)A Medicare MSA plan is similar farmers insurance near me to a Wellness Cost Savings Account (HSA), which you may recognize with from your years of employment. MSAs have 2 parts: a high deductible insurance policy strategy and an unique interest-bearing account. The Medicare Benefit plan transfers a sum of Medicare cash into the MSA that pays some, yet not all, of the plan's deductible.

Please call the strategy's customer support number or see your Evidence of Protection for more details, consisting of the expense sharing that relates to out-of-network services (paul b insurance medicare agent huntington).

There are 4 components of Medicare: Component A, Component B, Component C, as well as Component D. In basic, the 4 Medicare parts cover different services, so it's necessary that you comprehend the alternatives so you can select your Medicare coverage thoroughly.

There are four parts to Medicare: A, B, C, and D - paul b insurance Medicare Supplement Agent huntington.Part A is automated as well as includes settlements for therapy in a medical facility. Component B is automated if you do not have other healthcare insurance coverage, such as with an employer or partner. Component C, called Medicare Advantage, is a private-sector alternative to typical Medicare.

The Best Strategy To Use For Paul B Insurance Medicare Advantage Agent Huntington

Medicare has developed for many years and also now has four parts. While some are cheap car insurance quotes compulsory, others are optional.